car sales tax wake county nc

Any municipal vehicle tax assessed in. The term Motor Vehicle includes automobiles trucks buses campers trailers and motorcycles.

2020 Wake County Visitation Figures Released

You can print a 725 sales tax table here.

. The average cumulative sales tax rate between all of them is 725. County rate 60 Raleigh rate 3730 Combined Rate 9730 Recycling Fee 20. North Carolina Department of Revenue.

Historical Total General State Local and Transit Sales and Use Tax Rates. Individual income tax refund inquiries. Although the process of assessing annual vehicle property taxes may seem somewhat complex the nc vehicle sales tax is relatively straightforward.

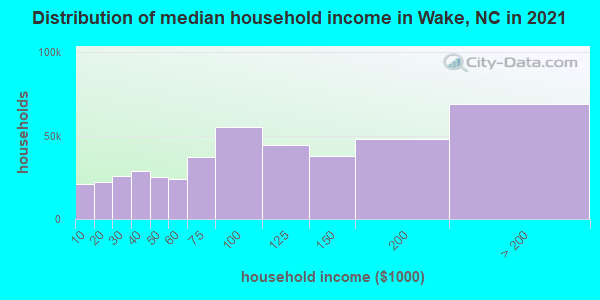

For vehicles that are being rented or leased see see taxation of leases and rentals. Wake County NC. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

You can find more tax rates and allowances for Wake County and. The state sales tax or highway use tax rate is 3. North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred.

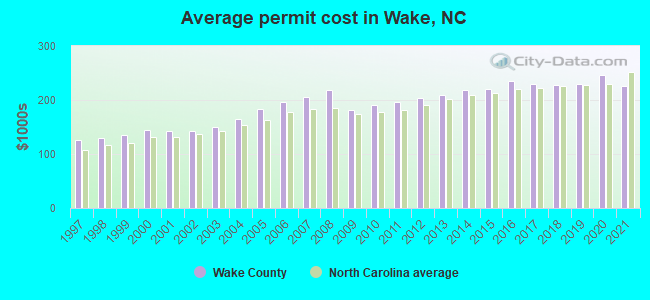

Historical County Sales and Use Tax Rates. You can find these fees further down on the page. For assistance in completing an application or questions regarding the Vehicle Rental Tax please call the Wake County Department of Tax Administration at 919-856-5999.

The North Carolina state sales tax rate is currently 475. The most populous location in Wake County North Carolina is Raleigh. PO Box 25000 Raleigh NC 27640-0640.

NCDMV FS-20 plate surrender form. If the vehicle was registered in Wake County last year but has moved to a new taxing jurisdiction within Wake County that is not reflected on the notice. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

There is a 3 highway use tax on used vehicle sales in North Carolina. As for zip codes there are around 60 of them. Property value divided by 100.

Historical Total General State Local and Transit Sales and Use Tax Rates. Wake Durham and Orange County Regional Transportation Authority Registration Tax. Your county vehicle property tax due may be higher or lower depending on other factors.

Rental Vehicle Tax Division. Plus 20 Recycling fee 196600 estimated annual tax. To appeal the vehicles value.

A full list of these can be found below. The Wake County Sales Tax is collected by the merchant on all qualifying. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. In addition to taxes car purchases in North Carolina may be subject to other fees like registration title and plate fees. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

Bill of Sale or a copy of the new state registration. North Carolina collects a 3 state sales tax rate on the purchase of all vehicles. Please be certain to provide the mailing address to be used on your refund check.

A single-family home with a value of 200000. There is no applicable city tax. If you are active-duty military and your home of record is not North Carolina.

Apex Nc Apex Nature Park Opens December 2013 Near Bella Casa Del Norte Park Apex Nc To attach a lien to real estate the creditor can take or mail the Abstract of Judgment to the county recorders office in any California county where the debtor owns real estate now or may own it in the future. Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25. Motor Vehicles are valued by year make and model in accordance with the North Carolina Vehicle Valuation Manual.

Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina. PO Box 25000 Raleigh NC 27640-0640. Vehicles are also subject to property taxes which the NC.

Do I have to pay sales tax on a used car in North Carolina. 2000 x 9730 194600. What is the sales tax on a car purchased in North Carolina.

Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates. The December 2020 total local sales tax rate was also 7250. As an example if you purchase a new truck for 60000 then you will have to pay 1800 in taxes.

Johnston street smithfield nc 27577 collections mailing address. This calculator is designed to estimate the county vehicle property tax for your vehicle. For tax rates in other cities see North Carolina sales taxes by city and county.

35 rows Wake. Always check with your local DMV. A motor vehicle offered for sale by a dealer to the end.

Contact your county tax. North Carolina Department of Revenue. Wake County Tax Administration.

Wake County Tax Administration. This is the total of state and county sales tax rates. Johnston Street Smithfield NC 27577 Collections Mailing Address.

North Carolina Department of Revenue. Values are based on the retail level of trade for property tax purposes. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes.

The current total local sales tax rate in Wake County NC is 7250. The calculator should not be used to determine your actual tax bill. The minimum combined 2022 sales tax rate for Wake County North Carolina is 725.

See reviews photos directions phone numbers and more for Nc Sales Tax In Wake County locations in Cary NC. Calculating North Carolina State Auto Sales Tax. Please enter the following information to view an estimated property tax.

The property is located in the City of Raleigh but not a Fire or Special District. Dry Cleaners for Sale in Wake County NC. The Wake County sales tax rate is 2.

This table shows the total sales tax. Wake County is located in North Carolina and contains around 14 cities towns and other locations. North Carolina car sales tax is easy to apply once you know the rules.

The 2018 United States Supreme Court decision in South Dakota v. 025 lower than the maximum sales tax in NC.

Over 150 Wake County Bus Drivers Skip Shifts During Sick Out Day 2 Board To Vote On Budget Tuesday Wral Com

Used Audi S4 For Sale In Raleigh Nc Cargurus

.jpg.aspx?width=350&height=400)

Multistate Tax Commission News

Used Cars Trucks Suvs For Sale Raleigh Nc Wake Forest Cary

Amazon Com Wake County North Carolina Zip Codes 48 X 36 Paper Wall Map Office Products

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Man And Woman Seriously Injured Car Flipped Multiple Times In Wake Forest Wral Com

Wake County Black Student Coalition Wcbscnc Twitter

Used Dodge Charger For Sale In Raleigh Nc Cars Com

North Carolina Nc Car Sales Tax Everything You Need To Know

2011 Carolina Skiff 238 Dlv For Sale Center Console Fishing Boats Center Console Boats Skiffs

1 Killed 1 Charged In Crash That Closed Wake Forest Road For Several Hours Wral Com

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Chevrolet Dealer In Wake Forest Nc

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Used Cars Trucks And Suvs For Sale Wake Forest Nc Raleigh Durham

Chevrolet Dealer In Wake Forest Nc

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More